Will This Financial Roadmap Be Your Unfair Advantage Over 90% Of German Natives?

(Who Currently Get Their Savings Inflated Away Barely Noticing It)

Expat in Germany?

Protect AND grow your funds by creating multiple income streams to take control of your financial security.

Despite the complicated bureaucracy and no matter whether you’re going to retire in Germany or elsewhere…

LIFETIMEACCESS

30 DAYS MONEY BACK GUARANTUEE

ALL MODULES IMMEDIATELY UNLOCKED

“INDIVIDUAL FINANCE STRATEGY” FOR FREE

6 MORE BONUSES

The Home Of Bureaucracy

Dear expat,

I don’t care if your native country is Malaysia, India, Bangladesh, Italy or Venezuela:

You probably noticed that things are a bit complicated in Germany.

Did you open up a bank account here? Most likely you’ve been asked to gather documents that can be filed in thick ass law books.

Despite still having one of the biggest economies in the world, Germany is known as “The Home Of Bureaucracy”.

Maybe the resulting confusion is one of the reasons why the vast majority of native Germans fail to notice that their savings are being stolen by money printing machines…

European Central Bank pumped 50 billion euros into German markets last week ALONE. That’s 80.000€ per second.

This IS inflation: Increasing the money supply without ensuring the economy’s growth simultaneously.

Rising prices… devaluation of the currency… and the fact that your money is losing purchasing power each day are just some of its potential side effects.

Bloomberg recently stated that “German Inflation Jumps To Highest In More Than A Decade”.

Yes, thanks to globalization, this issue fought its way all the way through the last corners of planet earth.

However, to gain your unfair advantage over 90% of native Germans, you first need to understand how things work HERE.

Because unless you understand the system where your financial strategy is being applied…

You won’t be able to make proper decisions within that system.

Decisions that will protect and grow your funds. Decisions that will create multiple income streams for you. Decisions that will provide your financial security.

My name is Marcel Kohmann. And I developed a 3-Step-Roadmap that will help you achieve that. I’m going to share it with you in just a minute.

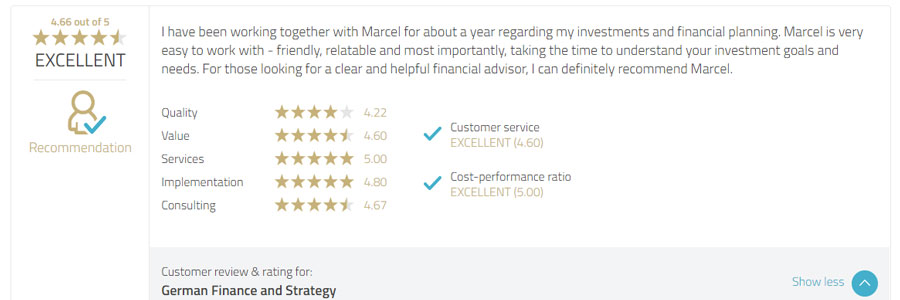

But first, have a look at what 150+ expats just like you have to say about my guidance.

3 Challenges Expats Need To Overcome

Opening up a bank account doesn’t really do much for you. Of course there’s more to take into consideration.

So how is it possible that these expats have an advantage over the vast majority of German natives?

They overcame the following challenges EVERY expat faces in the beginning:

#1 Language barrier and bureaucracy overwhelm: How will you be able to navigate through German bureaucracy regarding insurances, portfolio management and investment opportunities without speaking or understanding the language?

By watching out for the crucial elements. Certain “buzzwords” and specific lines to make sure you’re not making costly mistakes in signing contracts or documents. That’s how you manage bureaucracy almost effortlessly, without being a native.

#2 Generic financial advice: Most expats seek bank officials or visit local insurance offices you can find on every corner. Result: They sign financial products you can get on every corner. Without even understanding these products.

You want to be able to make a coherent decision for yourself. To build a portfolio that’s being profitable despite inflation and negative interest rates.

What you want as well is a solution specifically designed for expats. Taking advantage of DYNAMIC funds, in case you go back to your home country. Or plan to retire at your dream destination.

#3 Lack of capital and experience: “It’s not possible to make money without money…” An assumption that is entirely false. You don’t need to be an experienced investor to create a strategy that will grow your funds.

In fact, you can start saving and investing with as little as 50€ per month. Investing isn’t a cost, there is only a cost of NOT investing. The cost of cash that’s shrinking at your bank account… and the opportunity cost of profits you didn’t make.

What’s important for you right now is that you create a HABIT of investing, setting money aside for emergencies, marriage, retirement etc…

WHILE you learn how to create multiple streams of income for yourself and your family.

Because what your habit of saving will create for you is compound interest on your invested capital.

This ultimately results in multiple income streams.

Long term income streams so there’s no need to worry only on your main income anymore.

How does it work? That’s what I’m going to show you now.

The Roadmap For Expats In Germany

Step 1: Understand The System

As being said, you need to know the in’s and out’s of our financial and security system. This is key to developing a investment strategy later on.

Most people in Germany don’t understand that very system. That’s why Germans bunker approximately 1 trillion euros on their bank accounts combined. But please tell me: Why should you deposit money in your bank account when central banks keep printing money?

Step 2: Secure Your Assets

Your body is an asset. Your ability to work is an asset. Your house is an asset. Here’s a short definition: An asset is ANY economic resource you own or control with the expectation that it will yielt a future benefit.

So what you need to make sure is that your assets are secured in case of damage. No matter if it’s a health, legal, house or car issue. What’s important is that you have the right selection criteria so that you don’t waste money for useless insurances or other expenses.

Step 3: Put Your Savings Out There

Now that your assets are safe, you want to transform your savings into real monetary assets as well.

This is the right moment to create a personal investment strategy. Now you can decide how and where to invest your savings for above-average returns. Even as a complete beginner.

Result: Multiple Streams Of Income

You’ve taken the right decisions to provide for your financial security. What these 3 steps ultimately provide you with, too, is freedom.

The freedom of not being dependent on your main income anymore. The freedom to take a vacation or travel to your home country for 1-2 months without worrying about the money. Because you know your assets are safe. And your funds are growing strategically.

That’s what legendary investor Warren Buffett once said.

It’s true. Of course, you won’t magically transform into some sort of Warren Buffett by next year.

And you’re not necessarily up to building a billion-dollar portfolio, right?

You just want to understand the German financial system to make proper decisions.

You want to feel secure, because you know your finances are in place.

And you understood that you need to multiply your funds instead of letting them shrink on your bank account.

Because otherwise, you will continue trading your valuable time for money. For the rest of your life.

Now that’s a long term consequence even some smart expats fail to consider.

What everyone can comprehend though is the pain of making the first step… requesting important information and then reading through documents with technical language impossible to understand.

So where do those situations lead to?

I’ll tell you because my clients experienced them:

You don’t have the specific insurance to be covered in case of damage… Or you make a mistake and get in trouble with legal authorities…

You don’t know what kind of investment to choose without gambling and without being an experienced investor…

You’re listening to great investment success-stories of your friends without being able to tell such a story yourself…

I’m pretty sure you don’t want any of that.

What you want is financial security in economic uncertain times.

With the result of fellow expats or German friends wondering how you managed to build such a financial literacy…

And a rock-solid financial foundation despite inflation and potentially hyperinflation coming up in the near future.

That’s why I created a solution specifically designed for expats in Germany.

So that you can make your own decisions in one of the most private areas of your life.

I called this solution “German Finance Masterclass”.

In it, you’ll discover my entire 3-Step-Roadmap I’ve just presented to you as your personal guidance.

Using it is how you gain an advantage over 90% of German natives.

Enabling you to protect and grow your funds. By creating multiple income sources you’ll ultimately become independent from your main income.

Because you take control of your financial security yourself.

- Protect Your Assets And Your Savings

- Invest And Multiply Your Funds

- Understand The German Financial And Security System

- Create Multiple Income Streams For Your Financial Security

The “German Finance Masterclass” In Detail

So what exactly is inside the Masterclass? I’m going to show you now.

After completing the following modules, the headache that results from not knowing where to start in this bureaucratic jungle will disappear forever.

Even if I tell you in English, you will know how to apply it without speaking or even understanding German.

Because I’ll let you know about the crucial elements worth paying attention to. And cut out all the bureaucratic nonsense you don’t need to care about.

Module 1: The German “Sozialversicherungssystem”

In the first module you get to know the system where your financial strategy is being applied. We’re covering the 5 pillars that are keeping the social state secure. Then you’re armed with a foundation to save, manage and invest your hard earned money properly.

Module 2: Insurances

Germany is the country of insurances. But what kind of insurances do you really need? Which ones do you don’t need? Public or private health insurance? How can you get your kids involved? How do you make sure you’re covered in case of damage? In this module you’re gonna find the answers to these questions.

Module 3: Investments

Now, the fun part: How and where can you invest your money? How do you do that while saving taxes? In this module you’ll discover how you can put your savings out there and multiply them so you generate a profit. Without gambling and without being an experienced investor.

Module 4: The “Finanzamt”

The tax office: one of the most feared institutions in Germany. It’s important to cover though, because you don’t wanna work to give more money to the government than necessary. In this module you will find important tax tips so you can reduce your tax load or get a higher return at the end of the year.

That’s not all! I want to make sure that you definitely gain your unfair advantage over 90% of German natives. Ensuring that you really protect and grow your savings so you create multiple streams of income. And take control of your financial security independently…

That’s why I prepared the following FREE BONUSES for you:

0€

Bonus #1: “Individual Finance Strategy”

Of course, it can be hard to develop a personal investment strategy without experience in that field. Even if you know the “in’s and out’s” theoretically.

That’s why I’m going to develop your individual strategy. FOR FREE. To do that, we need to evaluate your situation first. We’re going to have a 15 minute consultation call so I can prepare our strategy session.

WARNING: Time is of the essence here. I’m currently running a marketing-test with this offer. And if I can’t make the numbers work, I might pull the entire offer down.

So you better claim your copy of the Masterclass now, if you want to take advantage of both the program and your “Individual Finance Strategy” for the ridiculously low price of just 17€.

Bonus #2: Understanding Your Payslip

If you are an employee, you need to understand the information on your payslip. In this video, I will explain the 11 units you find on your payslip and what you need to pay particular attention to.

BONUS #3: PDF “Arbeitslosengeld | Unemployment Benefit”

It’s always beneficial to rely on a safety net in case you lose your job. In this PDF-Sheet I let you know about the requirements, benefit calculation and important information on how to apply for the unemployment benefit.

BONUS #4: PDF “Elterngeld | Parents Allowance”

As parents you can claim a contribution for each child. It is paid according to months of life. Based on this sheet you’ll know how to apply and calculate the amount you will receive.

BONUS #5: PDF “Elternzeit - Parental Leave”

If you decide to spend time with your newborn child and leave your job for a while, you’re entitled to do that. In this PDF you’ll get the requirements and detailed instructions on how to request your parental leave.

BONUS #6: PDF “Kindergeld - Child Allowance”

Next to the parents allowance you can claim a child allowance as well. In this PDF-Sheet I’ll let you know what to pay attention to when you apply for it.

BONUS #7: PDF “Gesetzliche Pflegeversicherung - Statutory Care Insurance”

This insurance is part of the social security system and mandatory for employees in Germany. Which benefits can be claimed depends on your personal situation. What you must consider in each case you can find out here.

BONUS #8: PDF “Gesetzliche Unfallversicherung - Statutory Accident Insurance”

Even though this one is the responsibility of your employer, it’s important to know what to do in case of an accident at work. These PDF-Sheets are all you need to enjoy a hassle free financial life in Germany.

Conclusion

You saw it: After completing the “German Finance Masterclass” you’ll know EVERYTHING you need to know about the German finance and security system.

That’s how you claim your unfair advantage over 90% of German natives. It’s THE solution to end bureaucracy overwhelm and save yourself tons of headache.

Because you will have the knowledge and the means to protect and grow your savings strategically.

No matter whether you decide to retire in Germany or your home country.

Most importantly, you’ll be able to make your own decisions. Independently. No bank officials or institutions telling you what to do.

Just click the button down below the FAQ to get immediate access to the Masterclass.

Remember, this offer is limited. If I can’t manage to at least break-even on my advertising costs, I will pull the entire offer down.

So claim your copy of this truly limited offer NOW, end bureaucracy overwhelm in Germany and begin to take control of your financial future today.

Even if you get the course and all the bonuses for the ridiculously low price of 17€, you’re still protected by…

- A 30-Day Money Back Guarantee

I’m 100% sure that you’ll love the Masterclass or I’ll return your 17€ and let you keep the video course anyway.

Just write a message to the email on your receipt and I’ll give you back your 17€ with no questions asked. No hassle, no hard feelings.

FAQ

After purchase, you will receive your access data to my protected members area via Email. There you can work through the masterclass immediately and prepare to claim your unfair advantage over German natives who are barely noticing that their savings are being stolen in front of their eyes.

LIFETIMEACCESS

30 DAYS MONEY BACK GUARANTUEE

ALL MODULES IMMEDIATELY UNLOCKED

“INDIVIDUAL FINANCE STRATEGY” FOR FREE

6 MORE BONUSES

- Understand The German Financial And Security System

- Protect Your Assets And Your Savings

- Invest And Multiply Your Funds

- Create Multiple Income Streams For Your Financial Security

Your unfair advantage over 90% of German natives:

Protect AND grow your savings to create multiple income streams and take control of your financial security.

Despite the complicated bureaucracy and no matter whether you’re going to retire in Germany or elsewhere.